- Category

- Client Alerts

- Date

- April 07, 2025

- Title

-

Strategies for Preparing the New Hart-Scott-Rodino Forms

On Feb. 10, 2025, the new premerger notification and report forms under the Hart-Scott-Rodino (HSR) Act became effective. The new HSR forms make significant changes to the reporting obligations of both acquiring and acquired parties. In its release promulgating the new forms, the Federal Trade Commission (FTC) indicated that the average time required to complete the forms would substantially increase. For transactions involving horizontal or vertical overlaps between the parties, or acquiring persons with complex structures or that are part of a family of commonly managed entities, the preparation time could well exceed the FTC’s estimates. This note suggests strategies for shortening the time frame for completing the new HSR forms and for ensuring that the documentation provided to the antitrust agencies presents a careful and considered competitive posture.

The time allotted for filing the parties’ HSR forms in acquisition agreements is typically on the order of five to ten business days post-signing. This was entirely realistic with the old HSR forms, which had not fundamentally increased the filing burden on the parties for as long as current practitioners can remember. That is no longer the case.

The new HSR forms also require parties to produce certain additional reports and other documents relevant to an antitrust analysis of their transaction.

This note suggests strategies for shortening the time frame that may be required for completing the new HSR forms for a reportable transaction, and for ensuring that the documentation that must be provided to the antitrust agencies presents the transaction in a careful and considered competitive posture.

Introduction

Acquisitions of stock, noncorporate interests such as interests in partnerships and limited liability companies, and assets are reportable to the FTC and the Antitrust Division of the Department of Justice provided that certain threshold criteria are satisfied. One of these criteria is the size of the transaction, which today stands at a minimum of $126.4 million. Transactions that meet or exceed this threshold are potentially reportable to the antitrust agencies on an HSR form, which for the first time comes in two versions: one for the acquiring person and one for the acquired person.

The FTC is authorized by statute to collect a fine, currently up to $53,088 per day, from each of the parties if the transaction closes without the parties properly completing the HSR process. The FTC has imposed fines even when the HSR forms were filed but required documents were withheld.

Parties

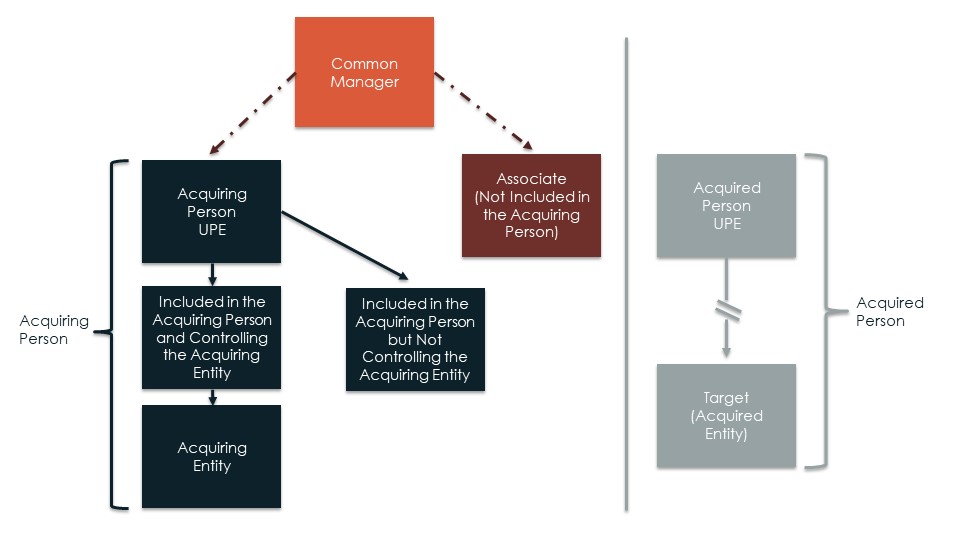

The following diagram illustrates the parties about which, or from whom, information is solicited in the HSR forms. The ultimate parent entity (UPE) of the acquiring entity, together with all the entities that this UPE controls, constitute the “acquiring person.” The UPE of the target, together with all the entities that this UPE controls, constitute the “acquired person.”

“Control” for these purposes refers to the ownership of 50% or more of the voting securities of a corporation or the right to receive 50% or more of the profits on distribution or assets on liquidation of a noncorporate entity such as a limited partnership or an LLC. Where a UPE sits atop a chain of entities, “control” is measured at each successive level of the chain; if the UPE controls entity A and entity A controls entity B, then the UPE will be deemed to control entity B. All entities that a UPE of an acquiring person controls, directly or indirectly, are considered to be included within that acquiring person. Information is generally required regarding all such entities, including those not participating in the transaction.

An associate of an acquiring person includes an entity under direct or indirect common management with the acquiring person but not within the chain of control of the acquiring person. Certain limited information must be furnished by acquiring persons with respect to their associates.

New Filing Requirements

Among other new requirements, the new HSR forms now mandate that parties:

- describe, in the case of acquiring persons, their ownership structures and, for funds and master limited partnerships, furnish any existing structure charts;

- provide a narrative explanation of the reasons for the transaction, and if a transaction diagram exists, provide that too;

- furnish all regularly prepared reports provided to a CEO and all reports furnished to a board of directors within the past year that address competition-related issues regarding products or services, (i) in the case of the acquiring person, that are also produced or furnished by the target, and (ii) in the case of the acquired person, that are also produced or furnished by the acquiring person;

- identify principal categories of their products and services, (i) in the case of the acquiring person, of all its included entities, even if uninvolved in the transaction, and (ii) in the case of the acquired person, of the target and all entities that the target controls;

- list and describe all competitive overlaps between (i) the acquiring person and (ii) the target and all entities that it controls;

- furnish sales and customer data for each overlapping product or service;

- list and describe supply information, (i) in the case of the acquiring person, regarding products, services or assets supplied to the target or any of its competitors; and (ii) in the case of the acquired person, regarding products, services or assets supplied by the target to the acquiring person or any of its competitors;

- list and describe purchase information, (i) in the case of the acquiring person, regarding products, services or assets that the acquiring person purchases from the target and any other entity that competes with the target to supply similar products, services or assets; and (ii) in the case of the acquired person, regarding products, services or assets that the target purchases from the acquiring person and any other entity that competes with the target to supply similar products, services or assets;

- furnish sales and customer data and provide a description of the relevant supply or licensing agreements for each supply or purchase relationship identified; and

- identify, in the case of acquiring persons, the officers and directors of their included entities who are also officers and directors of other companies in the same industry as the target.

Strategies

Although there are practical limits to preparing inputs to an HSR filing before a deal is signed, there are various strategies that parties can pursue that will make the process of preparing HSR forms faster and more efficient and accurately reflective of the competition story that they wish to tell.

- Structure. Parties that are part of a fund family or otherwise have a complex corporate structure should have prepared a description of their corporate structure. Parties that are funds or master limited partnerships should also identify, check for accuracy and be prepared to furnish existing charts diagramming their structure. There is no requirement, however, to prepare such charts solely for an HSR filing if they do not otherwise exist.

- Transaction Rationale. Parties should articulate a rationale for the transaction early in the process, with due regard for anticompetitive concerns. They should also confirm that internally generated documents prepared with respect to the transaction support, or at least are consistent with, this rationale. In this regard, the parties must identify to the agencies each document produced in connection with the HSR forms that confirms or discusses the stated rationales. It should be obvious that documents cannot be altered in connection with their submission to the agencies, and doing so would risk possible criminal sanctions.

- Involvement of Antitrust Counsel. The involvement of antitrust counsel early in the process of preparing deal-related memoranda and similar documents can assist parties in developing and documenting a pro-competitive or competitively neutral transactional rationale for their deal. Counsel can also help parties avoid statements that could later be seen as suggesting an anticompetitive rationale for a transaction. While drafts of memoranda do not generally need to be furnished to the agencies, there is an exception for drafts furnished to boards of directors or bodies that perform a similar function. This may include investment committees. Having the practiced eye of antitrust counsel review drafts before they are passed on to an investment committee can avoid having to produce to the agencies materials that are inconsistent with the pro-competitive or competitively neutral rationale of the transaction that the parties will be presenting with their HSR filings.

- Reports to a CEO and Board of Directors. Previously, all documentation required to be furnished to the antitrust agencies in connection with an HSR form bore some nexus to the transaction. The new HSR forms create exceptions to this rule. Parties must now produce regularly prepared reports delivered to a chief executive officer and reports delivered to a board of directors or similar body that analyze market shares, competition, competitors or markets pertaining to any product or service of the acquiring person that are also produced, sold or under development by the target. The same cautionary approach, and perhaps involvement of antitrust counsel, in connection with the preparation of transaction-related materials is now also advisable for ordinary course reports that are destined for a company’s most senior executive or its board.

- Lists of Products and Services. Rather than wait for the imminent filing of HSR forms, parties that frequently engage in transactional activity should consider maintaining a regularly updated list of products and services. A fund or other enterprise with several portfolio companies that participates in a transaction as an acquiring person will need to describe the principal categories of products and services offered by each of the portfolio companies, even those uninvolved in the transaction for which an HSR filing is being made. While only principal categories for all products and services must be described, maintaining a detailed list will also facilitate the identification of competitive overlaps, which must be described with particularity.

- Use of the Diligence Process to Identify Overlaps. During the pre-signing diligence phase, parties should be alert to the overlaps of products and services between the acquiring person and the target. The overlaps are not limited to current products and services, but also include those that are in the planning stage. The instructions for the new HSR forms caution that the parties should not exchange information for purposes of describing competing products and services. But that does not mean that the parties cannot educate themselves with regard to the businesses of the other party. Admittedly, this is easier said for the acquiring person, which will be conducting diligence of the business of the target whose purchase it is contemplating. But the acquired person as well should use the opportunity to familiarize itself using public or other sources regarding the businesses of the acquiring person and perhaps ask its counterpart for clarification or amplification of the information that it has encountered. Caution must be exercised on both sides, however, to avoid the impermissible exchange of competitively sensitive information.

- Identification of Supply and Licensing Agreements. Another exercise of advance preparation that may ease the burden of preparing the new HSR forms is in the area of supply and licensing agreements. Filing persons are now required to present information on purchase and supply relationships between the parties, and even with the competitors of their counterparty. Maintaining and regularly updating a list of significant supply and licensing agreements — both inbound and outbound — may guide the parties as they assemble the required information on purchase and supply relationships under the new HSR forms.

- Assembly of Data by NAICS Codes. The HSR forms collect information regarding competitive overlaps using the North American Industry Classification System (NAICS). While this feature of the new HSR forms has been substantially carried over from previous versions, it remains an area where preparedness will bear fruit during a cramped post-signing period for preparation of the HSR forms. Parties should maintain and regularly update a list of the products and services of their included entities by NAICS code, along with annual revenues and geographic data regarding the locations where revenues are generated or where customers are located. Different geographic data are required for different categories of NAICS codes, and the instructions for the HSR forms should be consulted for these particulars.

- Information on Minority Holdings. The HSR forms require parties to identify minority investments in entities whose products or services are categorized by NAICS codes that overlap with the NAICS codes of, (i) in the case of the acquiring person, the target and, (ii) in the case of the target, the acquiring person. Minority holdings are defined as holdings of 5% or more but less than 50% of the voting securities of any issuer or the noncorporate interests of any unincorporated entity. Maintaining and updating a list of minority investments and the NAICS codes associated with their products and services will save time when it comes to preparing an HSR form.

- Information on Associates. Acquiring persons are required to provide information on their associates' NAICS code overlaps with the target, both where the associates have a controlling interest in an entity with a NAICS code overlap and where the associates have a minority investment where an overlap exists. Funds or other enterprises that are commonly managed — but which are not commonly controlled for HSR purposes — should also maintain NAICS codes data, including for minority holdings, of their associates.

- Information on Directors and Officers. The new acquiring person HSR forms require information on directors and officers of the entities included within the acquiring person who also serve as directors or officers of entities within the same industry as the target. A regularly maintained and updated list of the outside director and executive positions held by all directors and officers of entities included within a party will facilitate the response to this new requirement.

Concluding Thoughts

The effort required to prepare the new HSR forms and the antitrust sensitivity of documents that must be furnished with them will depend on the existence and extent of competitive overlaps between the parties. Also, the amount of preparation in which a company should profitably engage will depend on the level of its transactional activity. A company for which an HSR reportable deal is likely to be a one- or two-time occurrence over the course of its life cycle might well disregard some or most of the strategies offered above. In contrast, private equity funds that are regularly shuffling their portfolio entities, adding or subtracting entities in the same or related space as other entities, would be advised to invest in preparation to smooth the way for HSR filings to come.

One stratagem, however, should be considered for deals and deal participants of all kinds.

Occasionally, parties to an HSR reportable transaction will file on the basis of a preliminary document, such as a letter of intent, term sheet or draft agreement. The new HSR forms validate this practice, with some toughening of the standards for the contents of the preliminary document. In most cases, however, parties will only begin preparation of their HSR forms after a definitive transaction agreement has been executed. For such parties, consideration should now be given to preparation of the HSR forms in parallel with the sprint to execution of a definitive agreement. For example, business overlaps and supply relationships may be explored, and where practicable, assembly of relevant customer data may begin, even as transactional terms are being finalized. Not only could this shorten the time between signing and filing, which will now materially increase, it may also sharpen the focus on any antitrust risks to the transaction. This stratagem may be advisable for many if not most reportable transactions.

Related People

-

-

Abbe L. Dienstag

-

- Counsel

- Co-author

- New York

- vcard

-

-

-

Randal D. Murdock

-

- Counsel

- Co-author

- New York

- vcard

-

-

-

Daniel DePasquale

-

- Associate

- Co-author

- New York

- vcard

-