- Category

- Funds Talk

- Date

- Nov. 01, 2017

- Title

-

Brexit and the Potential Relocation of Asset Management Services in Paris

The U.K. will exit the European Union on March 29, 2019, or at a later date agreed upon with the EU. On this date, the U.K. will likely become a third country vis-à-vis the EU and will need to have negotiated regulatory equivalences to access the single market through passporting rights for specific products or services.

U.K.-based asset managers, including key U.S. players managing EU portfolios from London, are therefore at risk of losing their access to clients located in the 27 other EU member states. Their right to operate across the EU is indeed established under, among others, MiFID and AIFMD passporting regimes, and it is not clear whether the U.K. will manage to negotiate new passporting rights for asset management and other financial services. In any case, movement of staff and transmission of data between the U.K. and the EU might get cumbersome, and clearing and settlement of euro-denominated transactions might be transferred to an EU member state.

View PDF version here.

While London is likely to keep its status as Europe’s main financial center, relocation of specific financial services can be expected, regardless of the passporting rights negotiated by the U.K. Financial services in the U.K. account for £30 billion in annual revenues, with asset management accounting for around £20 billion in annual revenue with £7 trillion in assets under management.

Paris as an Alternative Financial Center for Asset Managers

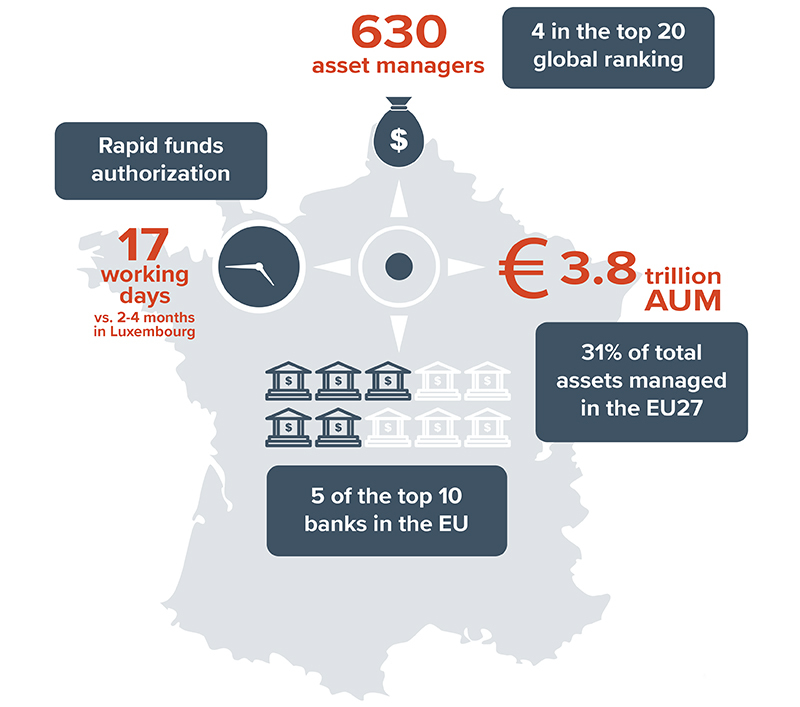

As the only European city on a par with London, Paris is home to the ESMA and five of the top 10 EU banks. It also benefits from a full financial ecosystem, proximity to high-profile clients, a deep pool of skilled professionals, good infrastructures and cheap office space.

Paris is already the leading asset management industry in continental Europe with more than 630 asset managers (among them, four asset managers are in the top 20 global ranking, and three global custodians are in the top 10 global ranking) and around €3.8 trillion in assets under management (i.e., 31% of the total assets managed in the EU27 and twice the size of Germany).

The Paris financial center also benefits from a high-quality regulatory environment and from efficient and responsive regulators. For example, funds authorization takes around 17 working days in France, against two to four months in Luxembourg. Finally, Euronext Paris launched a funds listing platform, “Euronext Fund Services”, on May 15, 2017.

Recent Efforts to Increase Paris’ Attractiveness

The perceived hurdles to relocation in Paris — a hostile tax environment, onerous employment laws and bureaucracy — are in the process of being overcome by various business-friendly reforms launched under French President Macron’s mandate. The measures, detailed by the prime minister in a speech in July 2017, are already implemented or in the course of being implemented.

Tax cuts

- Cut to the corporate tax: The corporate tax will be cut from 33% to 25% before 2022.

- Rescission of the highest bracket of the payroll tax: Remunerations over €152,000 will be subject to a 13.5% payroll tax, compared to 20% as of today.

- Capital revenues taxation reform: The scope of the French wealth tax (ISF) will no longer apply on financial assets but will be limited to real estate assets. Saving interests and financial products will be subject to a 30% flat tax.

- Extension of the impatriés regime: The advantageous fiscal regime (28% rate) for workers moving or returning to France will apply for eight years instead of five as of today.

- Abolishment of the extension of the European tax on financial transactions to intraday transactions.

- Commitment of the government to fiscal stability and predictability.

Deregulation of the labor market

- Labor law reforms: Those reforms have been enacted by way of ordinance on Sept. 22, 2017. They provide employers with more flexibility in the hiring and firing of employees, notably by (i) shortening the delay to challenge a dismissal, (ii) capping unfair dismissal compensation granted by labor courts, (iii) broadening the legal definition of economic layoffs and (iv) giving priority to enterprise-level agreements over branch agreements.

- Easier firing of finance workers: “Risk taker” employees’ (e.g., traders’) bonuses will no longer be included in the calculation of unfair dismissal compensation granted by labor courts, which will lower the cost of firing high-paid finance employees.

Simplified regulatory and administrative framework

- Simplification of financial regulation: To avoid making financial regulation more burdensome in France than in other EU countries, the French government pledged not to add any provision not mandated by EU banking and financial regulations when transposing them into French law. Existing additional provisions from past transpositions might be repealed: Kramer Levin Paris is an active member of the Paris Europlace Committee in charge of identifying French “gold-plating” transpositions of EU Directives and adjusting the French legal framework accordingly.

- International, English law commercial court: An international commercial court will be set up in Paris for financial contracts and more generally cross-border business law disputes. The court will apply English law and the proceedings will be held in English.

- Fast-track authorization by the regulators: In September 2016, the French Autorité des Marchés Financiers launched AGiLITY, a welcoming program for financial institutions supervised by the English FCA that includes access to English-speaking assistants, a pre-authorization process of under two weeks and full authorization in under two months.

- “Welcome to Paris Region”: In order to minimize red tape, a hub for informing and accompanying companies wishing to relocate their activities in Paris has been set up as of the end of 2016.

- New international schools will open soon in Paris.

- CDG Express: Acceleration of the construction of the CDG Express line between CDG airport and Paris City Center and, more generally, modernization of the transportation facilities with the Grand Paris project.